With growing frequency over the past few years, numerous companies have issued statements expressing their broader social purposes. The Diligent Institute's new report, ''Stakeholder Capitalism: Translating Corporate Purpose into Board Practice,'' explores recent trends in board members' attitudes and business leaders' practices regarding corporate purpose and stakeholder capitalism.

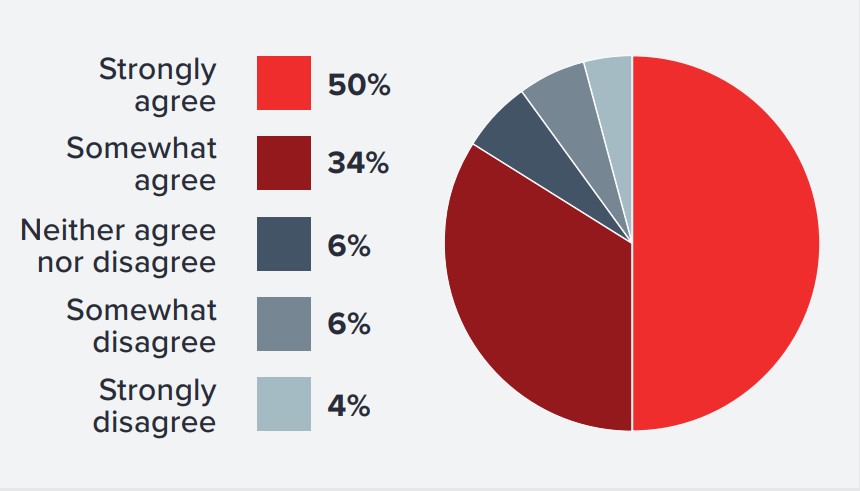

While there's a growing sense for some that capitalism is now changing in a fundamental way, that feeling is not universal. Many say corporate purpose is critical to organizations' long-term success and viability, but others hold fast to delivering shareholder value as the proven strategy. When presented with the following statement -- ''We are in the midst of a fundamental change in capitalism from a primary focus on shareholder return towards a system in which corporations must have a societal purpose and serve all stakeholders'' - a significant minority of respondents were neutral or disagreed.

While there's a growing sense for some that capitalism is now changing in a fundamental way, that feeling is not universal. Many say corporate purpose is critical to organizations' long-term success and viability, but others hold fast to delivering shareholder value as the proven strategy. When presented with the following statement -- ''We are in the midst of a fundamental change in capitalism from a primary focus on shareholder return towards a system in which corporations must have a societal purpose and serve all stakeholders'' - a significant minority of respondents were neutral or disagreed.

Along with compelling statistics that highlight attitudinal differences around the world, the survey offered business leaders the opportunity to comment in their own words, which they did with some passion. Sentiments ranged from skeptical to eager to embrace the principals of stakeholder capitalism and corporate purpose:

Along with compelling statistics that highlight attitudinal differences around the world, the survey offered business leaders the opportunity to comment in their own words, which they did with some passion. Sentiments ranged from skeptical to eager to embrace the principals of stakeholder capitalism and corporate purpose:

- How are board practices changing in response to the idea that stakeholder interests matter to enterprise viability?

- Has greater consideration of stakeholder interests in business strategy translated into real change and real action?

- How strongly do corporate leaders agree that we're witnessing a fundamental change to capitalism?

How a Global Financial Crisis Spurred Interest in ESG

This movement toward corporate purpose is a story driven by recent events. The purpose of corporations has been a focus of discussion since the 2008 financial crisis. As fiscal insecurity rose all over the world, stakeholders came to question corporate behavior regarding Environment, Society and Good Governance (ESG). Many shared a sense that businesses failed to service societal needs, and that companies emphasized shareholder benefits over the needs of other stakeholders. These concerns lingered even after markets began to improve.Davos and ESG

An updated ''Davos Manifesto'' from the World Economic Forum in 2020 stressed the importance of serving stakeholder interests. As ''a set of ethical principles to guide companies,'' the new Manifesto claimed that ''A company is more than an economic unit generating wealth. Performance must be measured not only on the return to shareholders, but also on how it achieves its environmental, social, and good governance objectives.''COVID-19 and ESG

The coronavirus (COVID-19) pandemic has impacted individuals and economies drastically around the world in recent months, raising new questions about potential disconnects between management, investor and stakeholder interests, prompting more discussion regarding ESG. Since the pandemic has come to influence all lives so strongly, many now feel that systemic change toward greater environmental and social responsibility could accelerate in today's COVID and tomorrow's post-COVID world.Black Lives Matter and ESG

The killings of people of color at the hands of police in the United States this spring sparked renewed protests in support of the Black Lives Matter movement all over the world. The intensified focus on systemic racism spurred corporate leaders to issue statements condemning racial injustice.''You cannot have a long-term sustainable business if you ignore the non-shareholder constituencies.''

How to Measure Trends Toward Stakeholder Capitalism

''Corporate purpose'' is a term that holds multiple meanings today - a lofty goal, a guiding principal, a governance topic, a buzzword - but even as corporate leaders issue statements to condemn injustice and make contributions to good causes, will ''corporate purpose'' translate into real action and lasting change? How can a shift in leadership sentiment be measured? Almost 5,000 registrants were invited to participate in a survey following Diligent Institute's ''Measuring Stakeholder Capitalism'' panel program last June. Over 400 respondents with knowledge of boards' stakeholder capitalism activities participated in the survey. Their organizations included public, private, nonprofit, government and other enterprises. Almost 300 respondents were board members, who answered director-specific questions regarding their attitudes. (Because respondents registered for a discussion on stakeholder capitalism, the report's results emerge from a self-selected population, and not the random selection a more formal study would entail.)Business Demographics by Industry

Directors' Attitudes Toward Stakeholder Capitalism, Corporate Purpose and ESG

''Meeting stakeholder returns has always been a necessary condition for meeting economic goals. One cannot have a successful and viable business without satisfying employees, community, etc.''For this report, Diligent Institute was interested in how board behaviors are changing as a result of new emphasis on stakeholder capitalism and corporate purpose. The survey found that, in the wake of COVID-19, directors anticipate stakeholder capitalism to be a significantly more frequent board discussion topic.

While there's a growing sense for some that capitalism is now changing in a fundamental way, that feeling is not universal. Many say corporate purpose is critical to organizations' long-term success and viability, but others hold fast to delivering shareholder value as the proven strategy. When presented with the following statement -- ''We are in the midst of a fundamental change in capitalism from a primary focus on shareholder return towards a system in which corporations must have a societal purpose and serve all stakeholders'' - a significant minority of respondents were neutral or disagreed.

While there's a growing sense for some that capitalism is now changing in a fundamental way, that feeling is not universal. Many say corporate purpose is critical to organizations' long-term success and viability, but others hold fast to delivering shareholder value as the proven strategy. When presented with the following statement -- ''We are in the midst of a fundamental change in capitalism from a primary focus on shareholder return towards a system in which corporations must have a societal purpose and serve all stakeholders'' - a significant minority of respondents were neutral or disagreed.

Along with compelling statistics that highlight attitudinal differences around the world, the survey offered business leaders the opportunity to comment in their own words, which they did with some passion. Sentiments ranged from skeptical to eager to embrace the principals of stakeholder capitalism and corporate purpose:

Along with compelling statistics that highlight attitudinal differences around the world, the survey offered business leaders the opportunity to comment in their own words, which they did with some passion. Sentiments ranged from skeptical to eager to embrace the principals of stakeholder capitalism and corporate purpose:

- ''These are political statements that folks make when times are good, but capitalism selects out the most efficient and effective companies and the others will go bankrupt.''

- ''The system is set up to incentivize short-term financial performance (or punish it) no matter how lofty the sustainability messaging.''

- ''... many companies still in denial of the change happening and even doubling down on implementing a very retrograde form of capitalism/using the excuse of the pandemic to do so, and very few companies are doing a significant amount of what's needed to actually bring about fundamental change.''

- ''In a world characterized by natural resource scarcity and radical transparency (the internet) you are simply not going to maximize financial wealth if stakeholder interests are not given due consideration.''

- ''Where the laws haven't caught up, societal pressure is there [to] force corporations to move the needle. In other words, just because you CAN excessively produce, pollute (within the context of the law), it doesn't mean corporations should and if they continue to think it's 'fair game' to do 'whatever' - well, good luck, those will not be the companies that succeed and win in the future.''

- ''You cannot have a long-term sustainable business if you ignore the non-shareholder constituencies.''

- ''Meeting stakeholder returns has always been a necessary condition for meeting economic goals. One cannot have a successful and viable business without satisfying employees, community, etc.''