Audit committee reports provide a quarterly and annual snapshot of the financial reporting process, the audit process, information on the company's internal controls system, and assurance that the company is in compliance with laws and regulations.

Audit committees need to be up-to-date on significant accounting and reporting issues and any professional or regulatory changes that might impact the company's financial statements. Audit committees also must have an understanding of how management collects data so they can assess whether the reports are accurate and complete.

There are various ways of formatting and reporting data. Some of the information in an audit committee report varies by industry. For this reason, the board and management need to reach an agreement about what information should be included and how it should be presented. The agreement should incorporate the requirements of the audit committee charter and the internal audit department charter. Audit committees should be familiar with the board's communication style and respond accordingly. It's common for audit committees to meet with boards and/or management separately to better understand the reporting framework and their expectations from the start.

At the time of audit reporting, board directors will want to know about any changes in committee members and their backgrounds. They may also what to review prior audit committee reports and minutes. Boards will also expect to have any documented arrangements about the expectations for the content in the report.

What Information Goes into an Audit Committee Report?

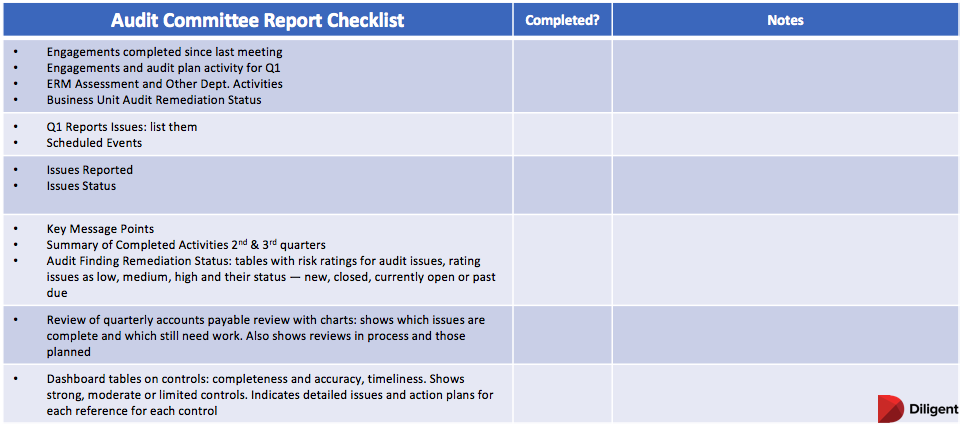

An audit committee report includes dashboard reports on current activities, annual plan changes, the status of the annual audit plan, and red-flag items or concerning trends. Also, an audit committee report includes the internal audit staff requirements, impact of limited resources and budget-cost comparison for the year. The audit committee report should include the results of any special investigations and a scorecard for department performance. The board will expect to see summaries on quarterly reports that have the most findings and other aggregated reports. Finally, audit committee reports should include information on monitoring and follow-up activities and the financial values of any issues of fraud.How to Format Quarterly Audit Committee Reports

Audit committees should be able to access all reports; however, they may decide not to review all of them. Management's goal is to summarize the most important information for the audit committee and the board. The board is interested in routine findings that are presented in a logical, consistent format. Audit committees report separately on matters that could affect financial reporting fairness, ethics breaches, fraud reports and reports of incidents where management responded to or acted on findings or recommendations contained in the report.

Typical Audit Committee Agenda

A typical audit committee agenda is much like the agenda for any other committee. An audit committee starts with a call to order, which is followed by a review and approval of minutes from the prior meeting. The next item for discussion is the audit committee report by the internal auditors, which is followed by the audit committee report by the external auditors. Other matters such as legal or compliance issues come next in the agenda and then the committee may decide to meet in executive session before the CEO and CFO give a formal presentation of quarterly or annual reports to the shareholders for formal approval. Finally, the chair announces the date and time of the next meeting and the committee adjourns.The Schedule of the Audit Calendar

The audit committee should hold a calendar to ensure that they're performing all the necessary duties at various times of the year. In the first quarter, the committee should do a review of the audit results and reports and review the internal and external quality assurance procedures. The second quarter is the time to review the budget, staffing and resources and note any constraints on resources. During the second quarter, the audit committee should also review the audit results and reports and confirm the independence of the internal audit. During the third quarter, the committee should tend to the scope, procedures and timing of the audits and, again, review the audit results and reports. In the fourth quarter, committees should review the charter, mission and objectives and review the audit results and reports. As necessary, the committee should appoint the chief audit executive and decide on compensation for the role. The Role of the Audit Committee Audit committees are responsible for reviewing the results of the audit with management and the external auditors. Committee members also review any matters that they're required to share with management and external auditors as required by generally accepted auditing standards. Audit committees are responsible for appointing external auditors, setting their compensation and overseeing their work. CPAs report to the audit committee rather than management. Committee members should set controls over financial reporting, have assurance of information technology security and be familiar with operational matters. At audit time, audit committee members meet with the external auditors to discuss any private matters. Committees will review their approach to the audit and take steps to coordinate the audit with the internal audit staff. Internal audit committees review and approve the audit plan, review staffing and organization, and meet with internal auditors and management on a periodic basis to discuss pertinent issues. Audit committees have the authority over their own budgets and manage the costs of external audits, and this process should lend assurance to investors that the financial reporting is accurate. Diversity on boards is a major topic and part of that diversity includes having board directors who have some knowledge and expertise in finance and accounting. Audit committees should have at least one person on the committee who is considered a financial expert. Today's boards benefit from a highly secure board portal like Diligent Boards where board administrators can set up granular permissions for authorized access to audit committee materials. State-of-the-art security ensures that sensitive board material won't get into the wrong hands. Diligent's Governance Cloud is composed of a suite of digital tools that includes Nominations, where boards can also find a database of over 125,000 highly qualified candidates for board directors, audit committees and senior leadership. Digital tools are the best way to protect the important work for which audit committees are responsible.

Media Highlights

Environmental, social and governance (ESG) issues have become more complex and multifaceted than ever before. At the same time, ESG continues to ascend on board and leadership agendas.

In this buyer’s guide, we explore what a market-leading ESG solution should look like and highlight the key areas organisations should be prioritising as they embark on their search.