The subject of board composition best practices has become increasingly complex. Because boards sometimes need greater levels of expertise, many are casting a wider net to round out their board composition. Taking a more refined approach to board director recruitment also means that board director seats are more likely to be open to candidates who have no existing board director experience.

Independence, diversity, commitment, expertise, gender and many other issues make up best practices for board recruitment. Overall, board composition should strongly reflect the strategic priorities of the business.

Creating an Effective Board of Directors: Board Composition Best Practices

Effective boards reflect the strategic priorities of their companies. They also reflect the company's strategic priorities and challenges. It's wise to choose board directors who understand the board's unique areas of risk and the diversity of its stakeholders. Independent non-executive directors are crucial to a board's success. It's common for all board directors to come under scrutiny by shareholders and the public. Transparency in choosing board director appointments is a major issue for shareholders. Boards and their nominating committees need to be able to be objective in their choices, base their choices on the candidate's merits and be able to explain their reasoning for whom they choose. Diligent's board self-assessment tool streamlines the process for board evaluations and helps to demonstrate that boards are giving board director recruitment the due diligence that it requires. Shareholders sometimes expect that boards will choose board directors using mediation through professional advisors. This is a preferred method for some because it brings a broader range of candidates, which will hopefully allow the board to meet the full range of special skills it needs. Today's corporate boards should evaluate their compositions frequently to ensure they have the right composition to effectively lead the company. A group of effective board directors will make an effectively composed board. Best Practices for Board Size Corporate boards should be large enough to bring a wide range of perspectives and competencies into the boardroom to encourage robust debates and discussions. The generally accepted size for corporate boards is between eight and 12 board directors. Boards need to be large enough to have enough committees to do the work. In addition, the committees need to have enough members on them to do their work. Boards may be tempted to increase the size of their boards because of their desire to have gender diversity and to fill all the needs for specialist issues such as cybersecurity. Boards must find the balance between having adequate expertise while not expanding the board unnecessarily. Boards that are too large lose effectiveness. Regardless of the board's size, all board directors are expected to contribute to the success of the board. Supervisory boards are often larger. Independence on Corporate Boards Best practices for board composition hold the expectation that the minimum requirement for boards is to have the majority of directors be non-executive, independent directors. In addition to being independent of board business, ''independence'' also refers to having independent thinking so that the board is not likely to cave to groupthink. It's best if board directors don't have any personal or commercial conflicts of interest. If any conflicts should arise, board directors should declare the conflict and refrain from voting on related matters. Independent board members shouldn't be a recent former member of the company. There should be enough time between employment and directorship for the board director to be objective. To be truly independent, board directors shouldn't have any financial relationships with the company or its counterparts. Independent directors shouldn't have interlocking directorships. Also, it's vital that board members not be selected to fill a void in executive weakness. Best Practices for Board Terms Best practices for board terms require a dynamic approach. A director's longevity on a board isn't necessarily a sign of director success. Having fixed, staggered terms encourages board refreshment and renewal, which will yield a revolving set of fresh and innovative ideas and thought processes. Term limits for board directors offer greater accountability and transparency on the board. Shareholders have also been expressing their desire for companies to set board terms. Best Practices for Board Diversity The search for board director candidates who offer diversity is another area that has forced boards to widen their pool of candidates. Having diversity on corporate boards is a healthy sign because it ultimately leads to better overall decision-making. It's also important that board directors are diverse in their thinking patterns because it brings a variety of experiences, perspectives, interests and thought patterns. In some arenas, politics and regulations are becoming players in making demands for greater board diversity. Boards should also look for diversity within their board chairs and CEOs.Board Recruiting Skills Matrix

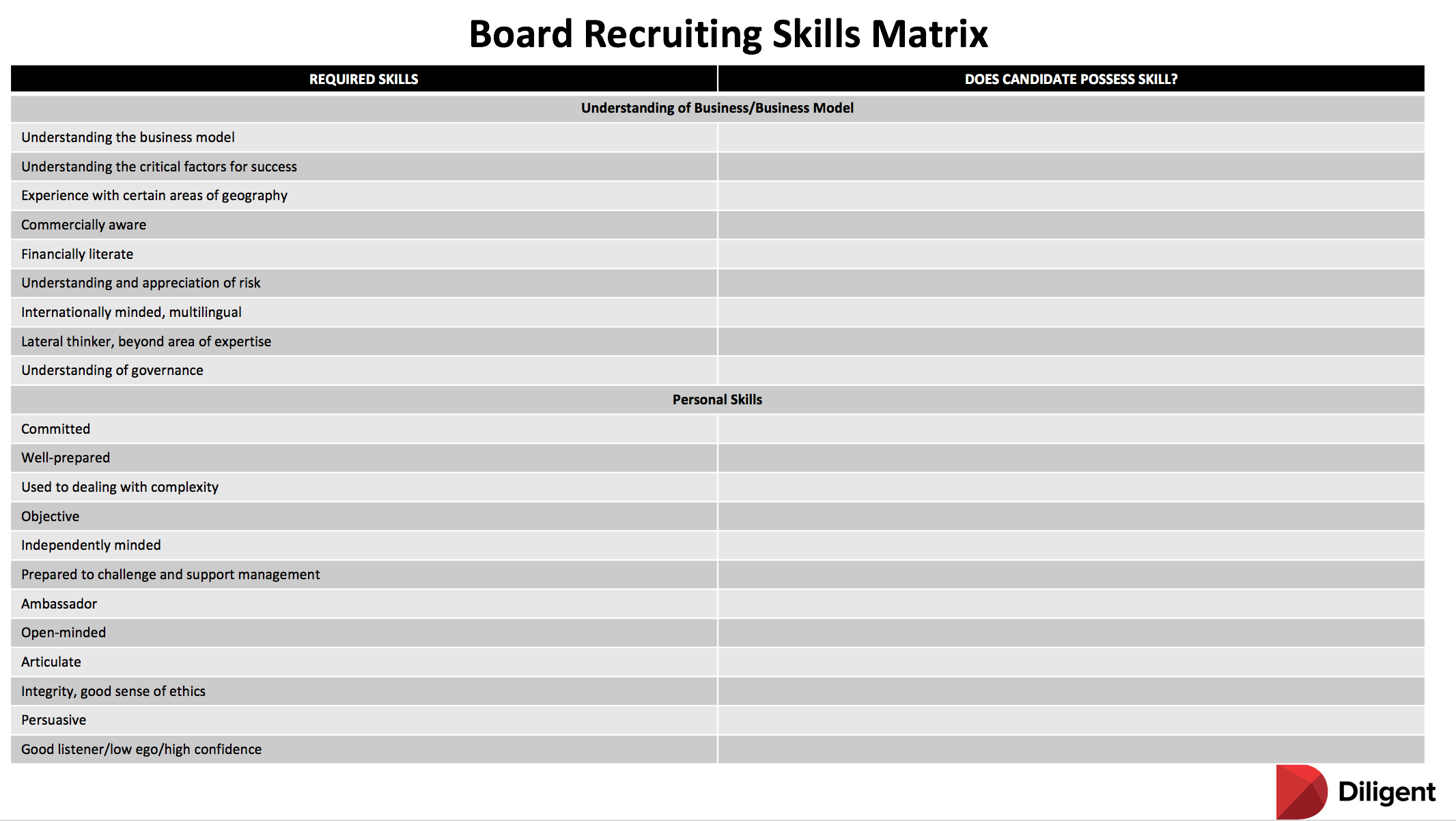

Nominating committees may consider adding an infinite number of skills, abilities and characteristics to their board preferences. Use this skills matrix to better identify the skills that you need to fill current or future board vacancies.

Best Practices for Board Composition When Serving Multiple Board Directorships

The issue of board directors serving on multiple boards is another board composition issue where the trends are changing. In past years, no one much considered how many boards a director served on. With new demands and pressures, best practices suggest that board directors should serve on no more than five boards. Certain times of the year get hectic for board director schedules, such as around the time of the annual general meetings. In the interests of time, it may not be possible for directors to serve on more than three or four boards, especially if they have to fly across various continents. Beyond these reasons, if even one company were to go into some sort of crisis, a board director would have to give that board priority with his attention. Board directors need to be available for at least 20-30 days a year and be committed to attending six to 10 board meetings throughout the year.

Media Highlights

Environmental, social and governance (ESG) issues have become more complex and multifaceted than ever before. At the same time, ESG continues to ascend on board and leadership agendas.

In this buyer’s guide, we explore what a market-leading ESG solution should look like and highlight the key areas organisations should be prioritising as they embark on their search.