A complete financial report comprises three shorter reports, including a balance sheet, a profit and loss statement and a cash flow report. Each report depicts different financial information and serves a different purpose in assessing a company’s financial status and outlook. Taken as a whole, the three reports create the complete financial landscape of the company. Business owners can make better and more informed financial decisions by reviewing all three reports on a continual basis and understanding how they work together. Increased profitability is often the result for business owners that pay careful attention to all of their financial reports.

A highly secure board portal is quickly becoming an essential tool for serious business owners that are diligent about monitoring their financial statements.

See the following templates for a closer look at the basic financial reports for every company.

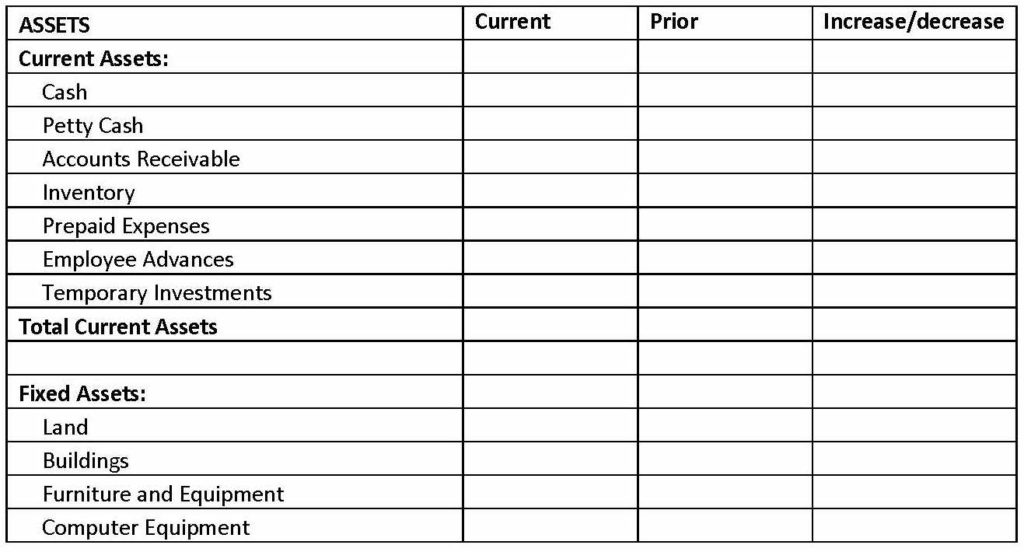

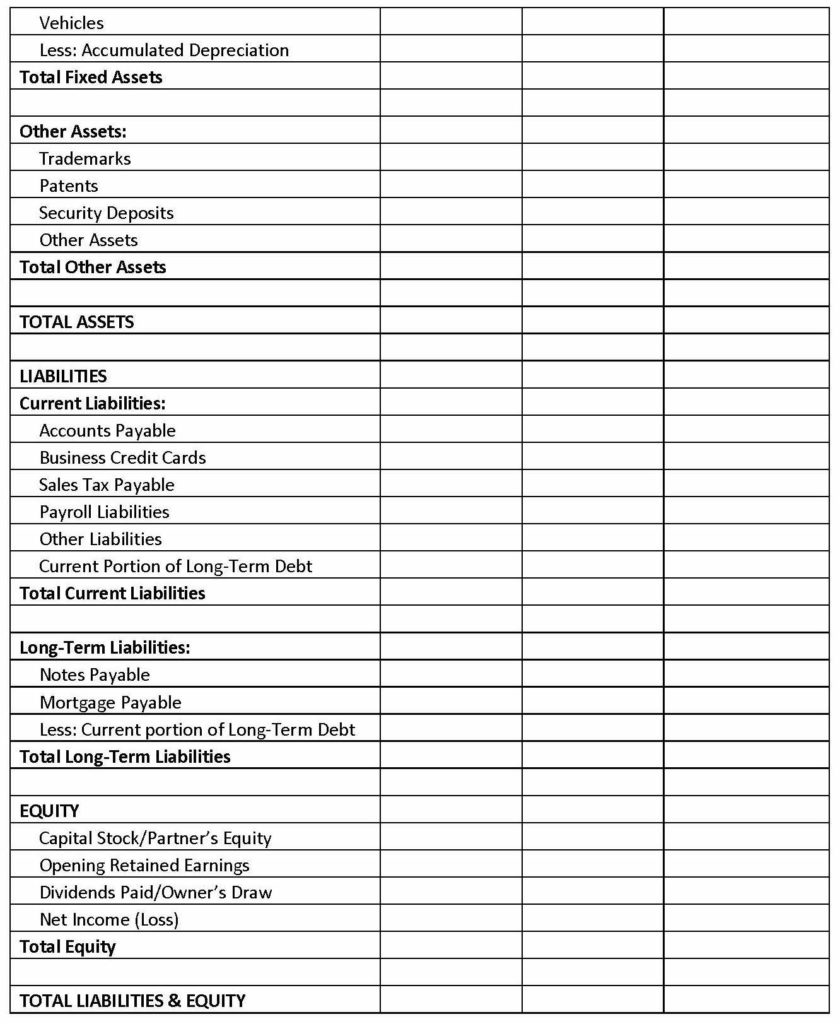

Financial Report Template Balance Sheet

A balance sheet looks at three parts of the financial picture, including a company’s assets, equity and liability for any designated time period. The balance sheet records figures for the current period and compares them to the prior period, showing a financial increase or decrease.

The value of a balance sheet is in getting a glimpse of what the company owns, how much they owe and the true value of the business. A balance sheet’s value lies in helping business owners find hidden costs; by cutting these costs, it’s easier for them to maximize their profits.

Following is a template of a sample balance sheet:

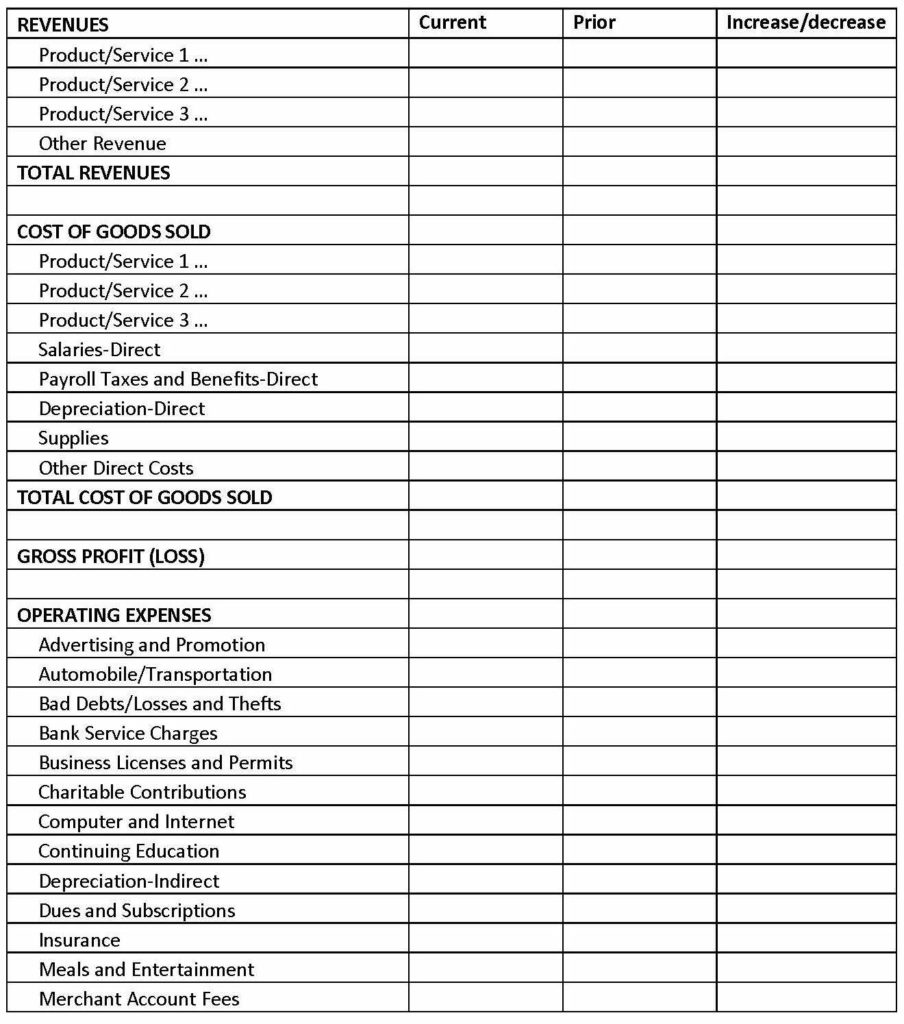

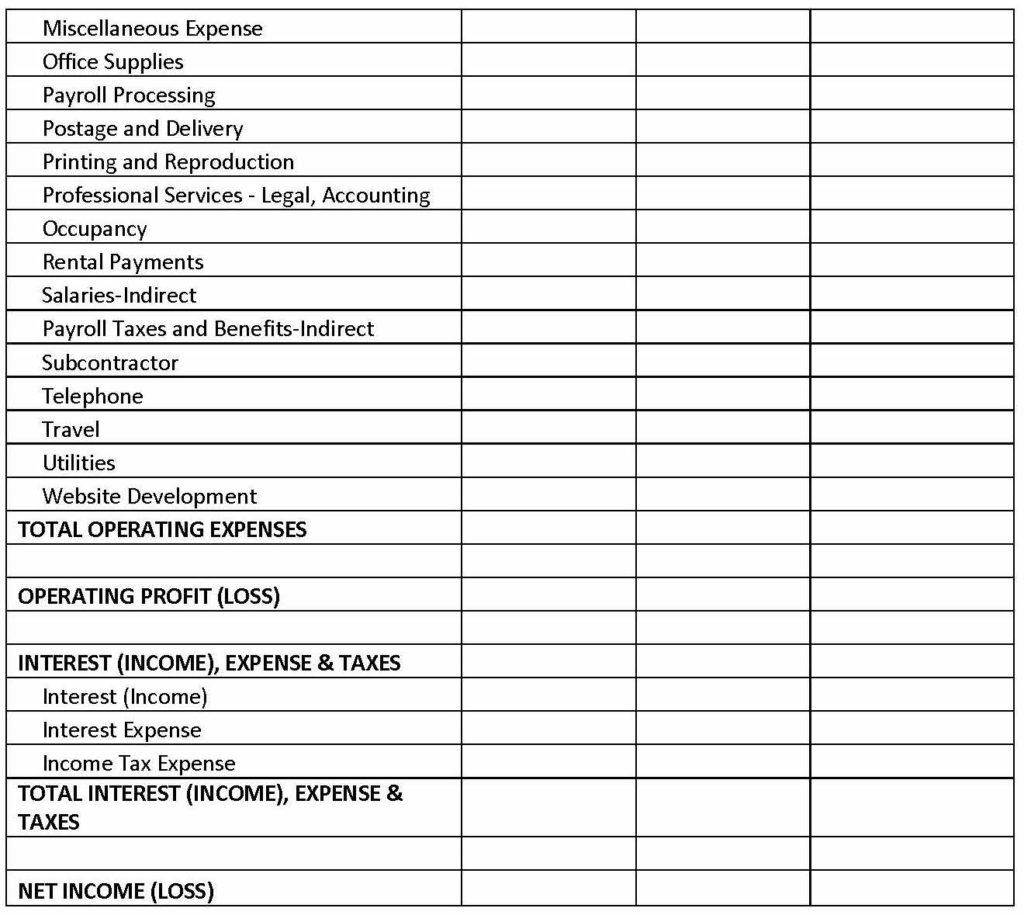

Profit and Loss Statement

A profit and loss statement (P&L) is sometimes referred to as an income statement, statement of operations, earnings statement, expense statement or statement of financial results. This financial statement provides a listing of a company’s revenues, costs and expenses for a specific period, which is usually quarterly or annually. The P&L statement depicts data about a company’s ability to produce a profit.

Following is a template of a sample profit and loss statement:

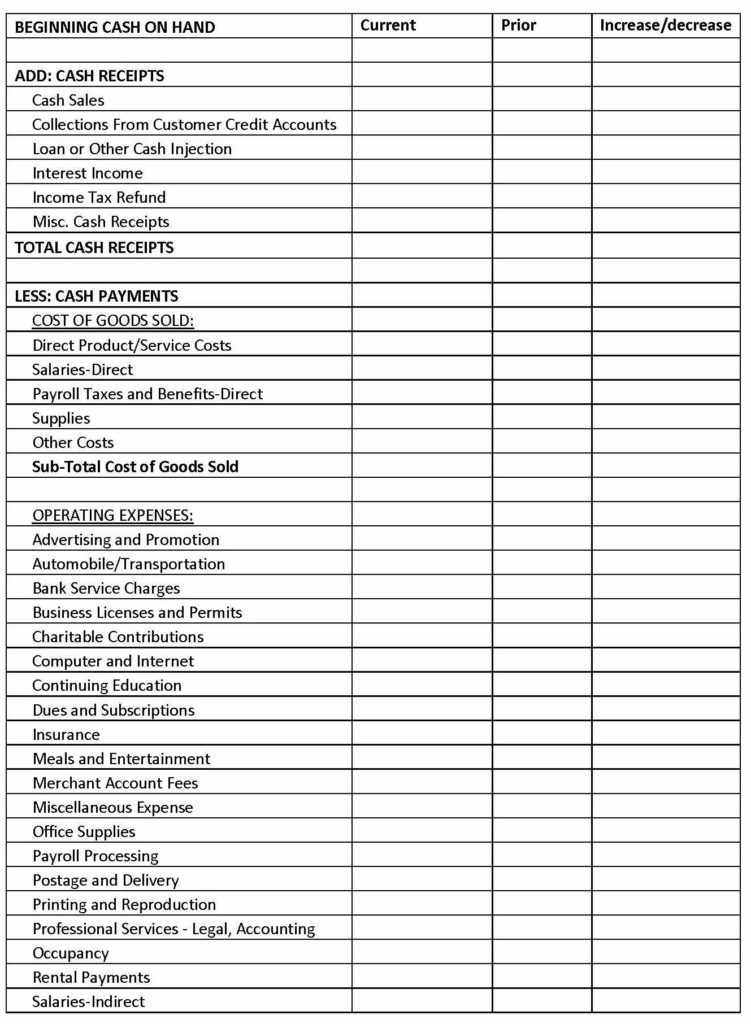

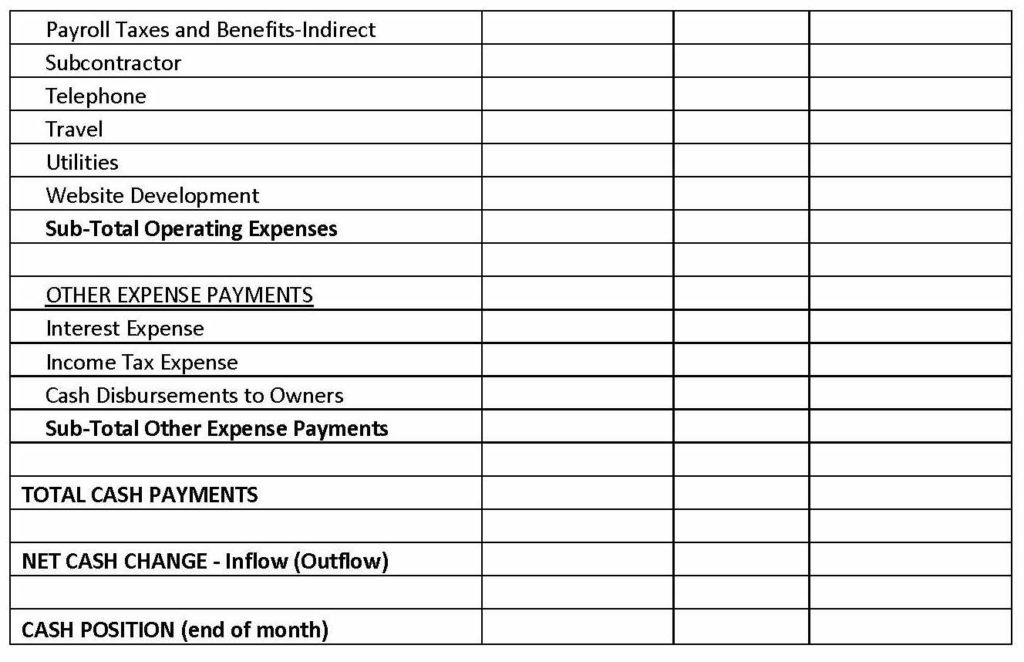

Cash Flow Statement

A cash flow statement (CFS) is also called a statement of cash flows. As its name suggests, a cash flow statement provides a summary of a company’s cash or cash equivalent that flows into and out of the company. The CFS is a mandatory part of a business’s financial reports, along with the balance sheet and the profit and loss report. It details how well a company performs in generating cash to pay its debts and fund its operations.

Following is a sample cash flow statement template:

How the Three Financial Reports Help Business Owners Increase Cash Flow

One of the most immediate concerns for business owners is having enough cash on hand to operate on a monthly basis. The results of the three reports together give a business owner the percentage of profit he or she makes on every dollar sold. Increasing the profit percentage will help the owner generate more cash with which to operate.

By taking a look at the items on a company’s accounts receivable and inventory lists, a business owner may be able to find items that are unnecessarily tying up cash and take steps to increase cash flow, such as reducing inventory or stepping-up efforts to collect outstanding payments.

A Diligent board portal drives accuracy and efficiency for business owners and their boards in preparing and storing their financial statements. Diligent Corporation developed a highly secure software solution that board directors can access entirely online so there are no bulky paper notebooks or files to manage.

Businesses that properly review and monitor their balance statements, profit and loss statements, and cash flow statements have the opportunity to make timely changes in their business strategies before cash flows become too narrow. A Diligent board portal is an indispensable tool for helping to keep the flow of cash moving and corporate finances in the black.