In a recent webcast, Answering Investors' Calls for Transparency, Donnelley Financial Solutions and Equilar outlined several ways for boards to improve their disclosure for the 2017 proxy season. In this blog, we'll focus on two areas of proxy disclosure that we consider particularly challenging: (1) peer group selection and (2) board composition.

Peer Group Selection

Selecting a peer group is inevitably tricky, as there's no one-size-fits-all formula that extends across all companies or even industries.'Whether somebody is highly compensated, fairly compensated, or under-compensated, it's a relative comparison,' said Equilar's CEO David Chun during the webcast. 'What it comes down to is, 'Who do you consider as a peer?' And that's a very sensitive topic with the investor community.'

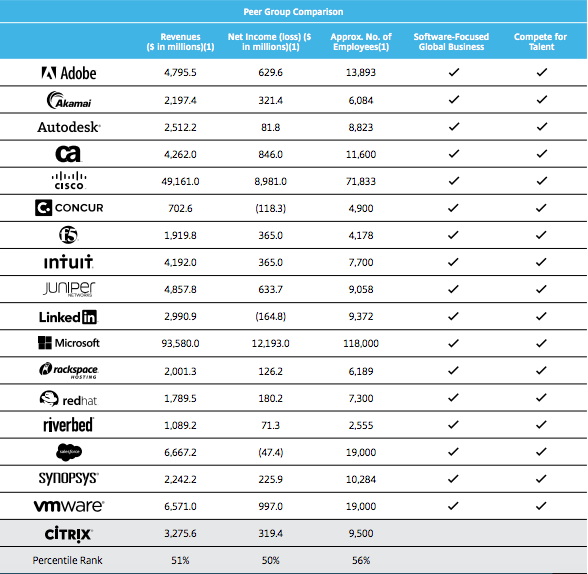

For large-cap companies, a peer group typically consists of about 17 peers, which are selected using criteria like company size, industry, geography, or level of competition.

During the webcast, Ron Schneider (Director of Corporate Governance Services, Donnelley Financial Solutions) explained that failed say-on-pay votes are often caused by poor peer group selection, rather than by the pay itself. A common mistake boards make is in selecting 'aspirational peers' (i.e., companies significantly larger on various metrics) and failing to disclose how they got there. Investors are left to assume that boards are using these inflated peer groups to justify higher pay. All the more reason boards must tell their story...

Important Proxy Information Must Be Visualized

Leaving important information in the body text of the proxy statement is like burying a dead body on Page 2 of a Google search (it may never be found). For peer group disclosure, we're seeing several creative solutions that are helping corporate boards tell the story of their peer group selection.Peer Group Roster & Ranking

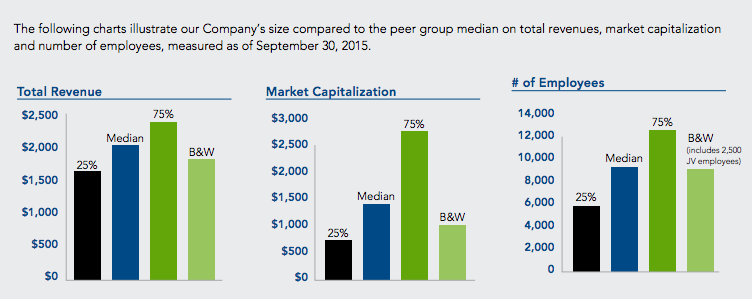

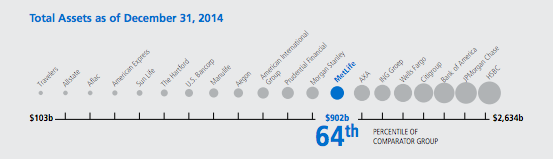

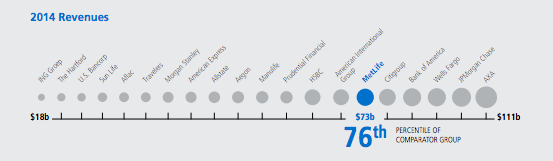

A peer group must be displayed in a way that easily allows the reader to scan and gauge the company's position or ranking across the selection criteria. As the examples below will show, there's no one right way to visualize the information; rather, the focus is on readability and the selection criteria.

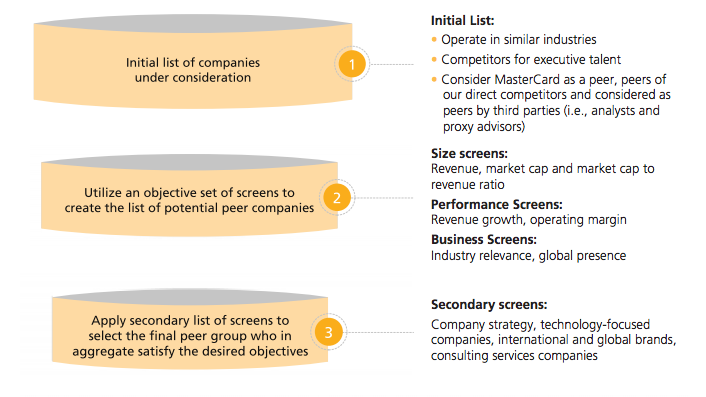

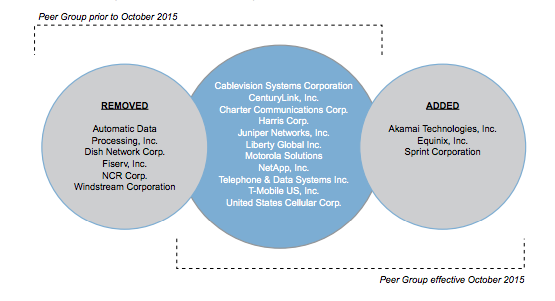

Selection Process & Updates

How the board arrived at its peer group is just as important as the roster itself. In the first example below, MasterCard walks investors through their peer selection process, step by step. In the next example, Level 3 Communications gives a quick view of who was added/removed from last year's peer group; the accompanying text then supports the board's rationale for making those changes. Again, the goal is to highlight for the reader the most relevant information, which will likely change from year to year depending on any recent changes in the peer group.

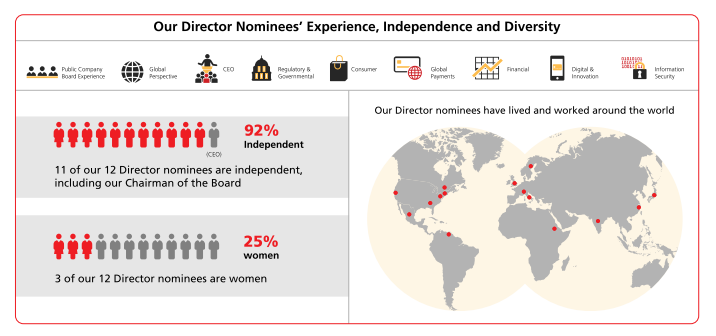

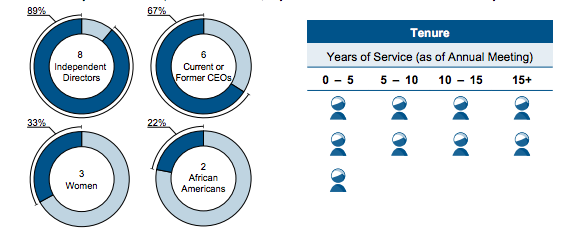

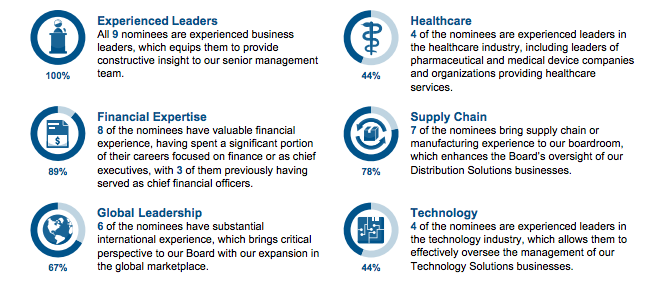

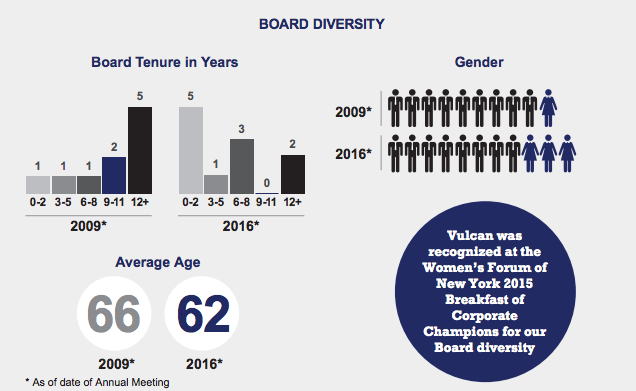

Board Composition

If you've glossed over board composition in past proxies, we suggest you devote a little more time and attention. As we've discussed for the past several weeks, institutional investors and proxy advisors have identified board composition as their top priority in 2017. Investors (and particularly activists) will be looking for diversity of gender, race, skill sets, tenure, industry backgrounds, and even generational perspectives. A boilerplate metric for 'average board member age' doesn't do much to illustrate a diverse spread of characteristics. Consider the following visualizations:

The Bottom Line

What was once a 'missed opportunity' is now a matter of survival. Those companies who ignore the storytelling power of the proxy may soon find themselves in activists' crosshairs or in the wake of a failed say-on-pay vote.For those boards looking to improve their communication for the 2017 proxy season, we strongly recommend the webcast, Answering Investors' Calls for Transparency, which is now accessible for playback. Both Donnelley Financial Solutions and Equilar deliver helpful insights regarding peer groups and board composition. And you may even hear a familiar voice moderating the discussion!