Uncover Governance & Disclosure Best Practices

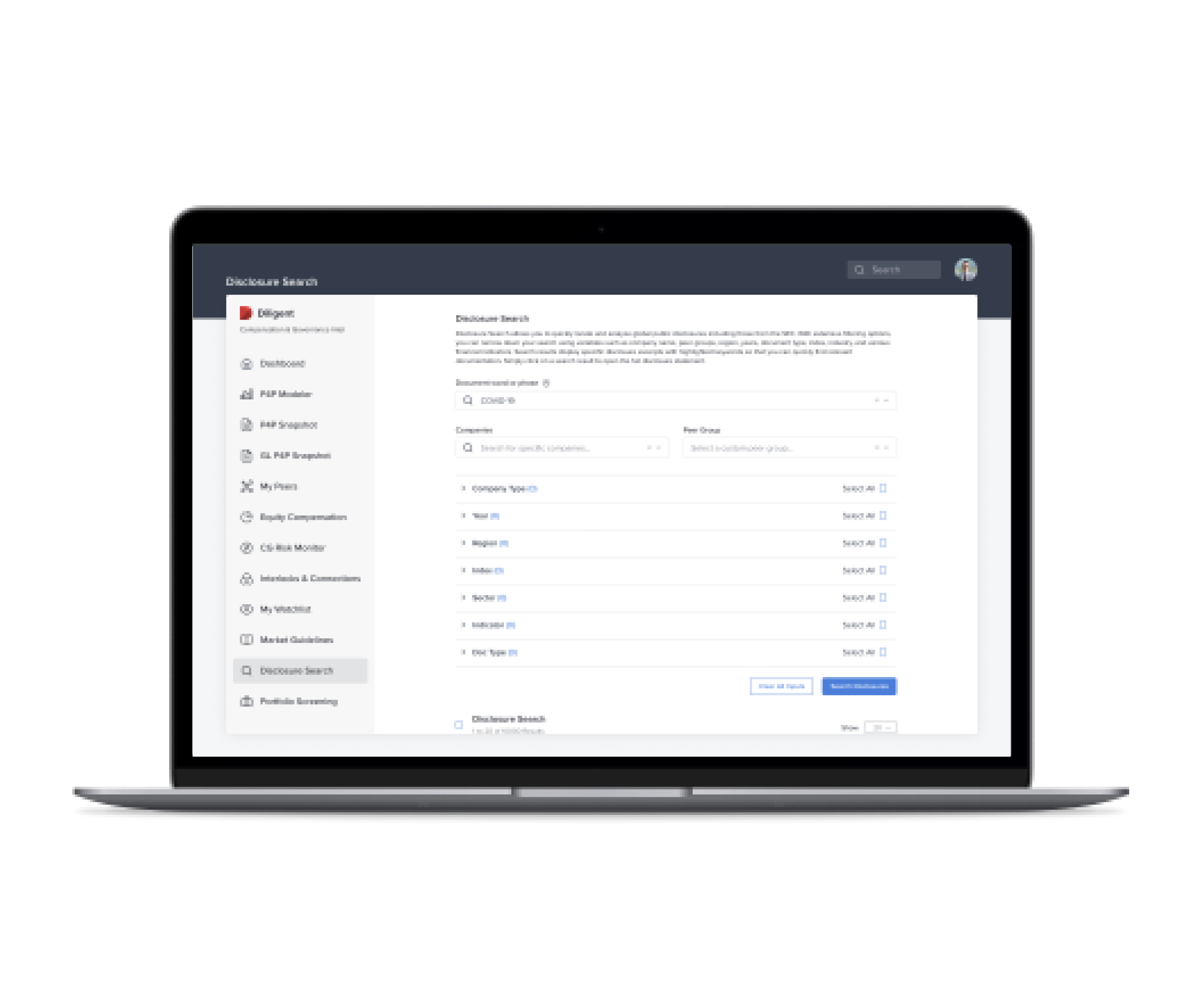

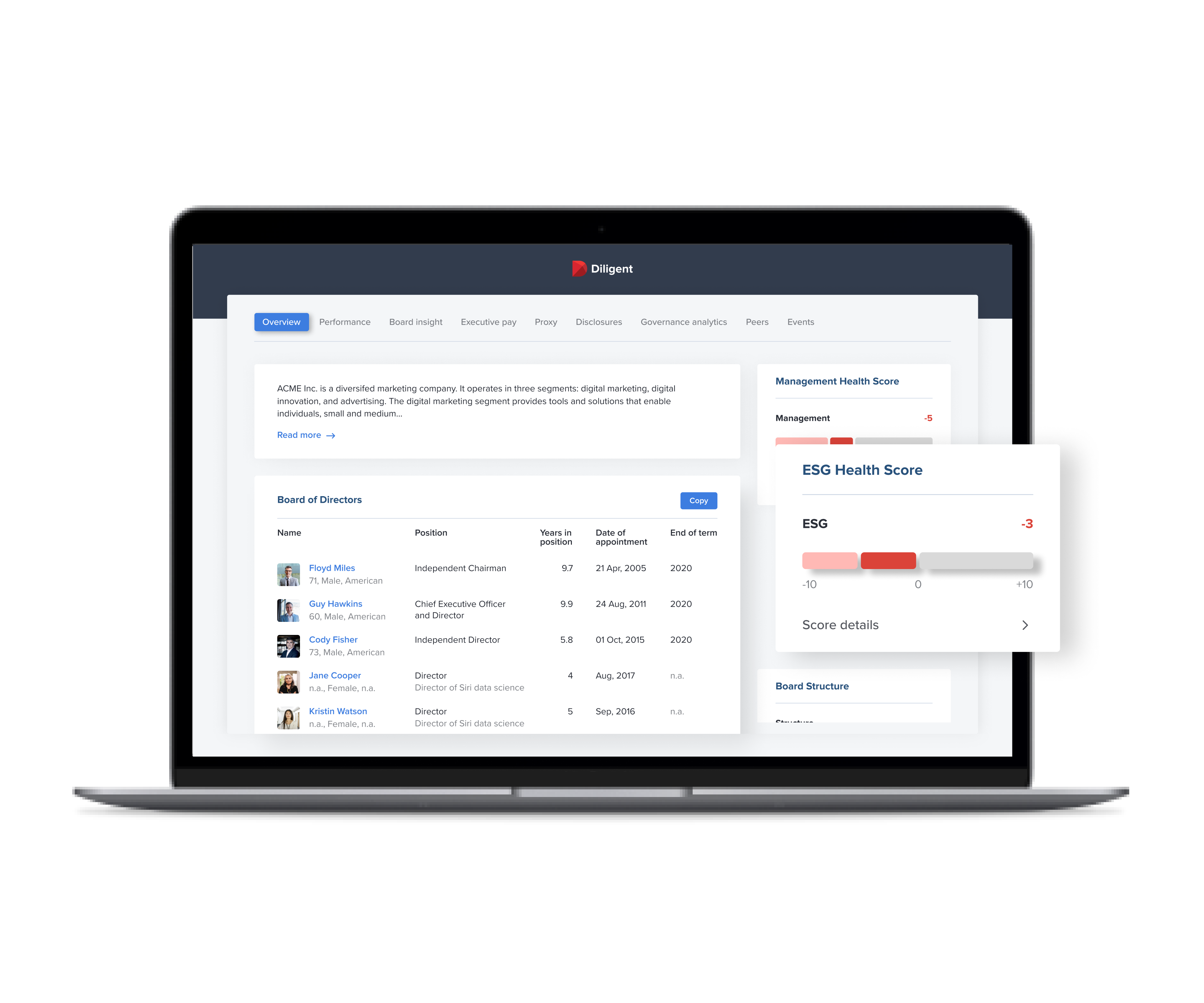

- Create specific peer groups to quickly search across multiple relevant organizations

- Conduct deep analysis on companies that are disclosing information on sustainability, human capital management and other ESG policies

- Receive real-time email alerts on changes and updates from peers or competitors

Learn More About Our Board Benchmarking Solution

Whitepaper

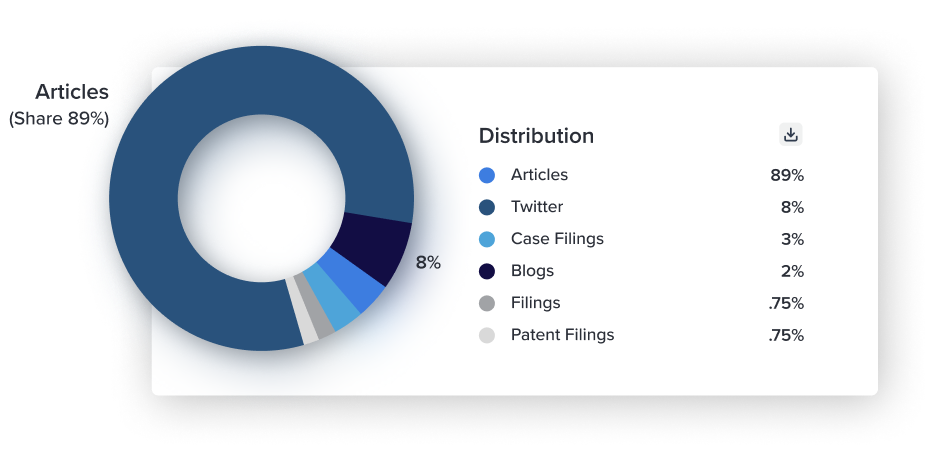

Using Diligent’s patented technology, instantly review over 90,000 news and social media sites

CERTIFICATION

The board's oversight of cybersecurity risk is mission critical. Get certified with the essential knowledge and expertise today.

WHITEPAPER

Proactively design and benchmark your plans ahead of your AGM

Related Insights & Resources

Whitepaper

Regardless of whether a company’s journey to the public markets involves an IPO or a de-SPAC, the formula for safeguarding stakeholder interests and unlocking long-term shareholder value is the same: good governance.

WHITE PAPER

Be ready post-IPO, as investors and stakeholders will continue to monitor your organization’s disclosures closely. Our checklist details the seven priorities you should consider to ensure ongoing resilience.

WHITEPAPER

Stakeholders and shareholders continue to shine an increasingly bright spotlight on environmental, social and governance (ESG) issues. Regulators are also intensifying their scrutiny; recent announcements from the SEC and G7 nations indicate that organizations will soon face ESG and climate disclosure requirements.